For more information about artwork donations, please email the Collection Development Office or call our main line at +65 6690 9474 / 6690 9401.

Donate an Artwork

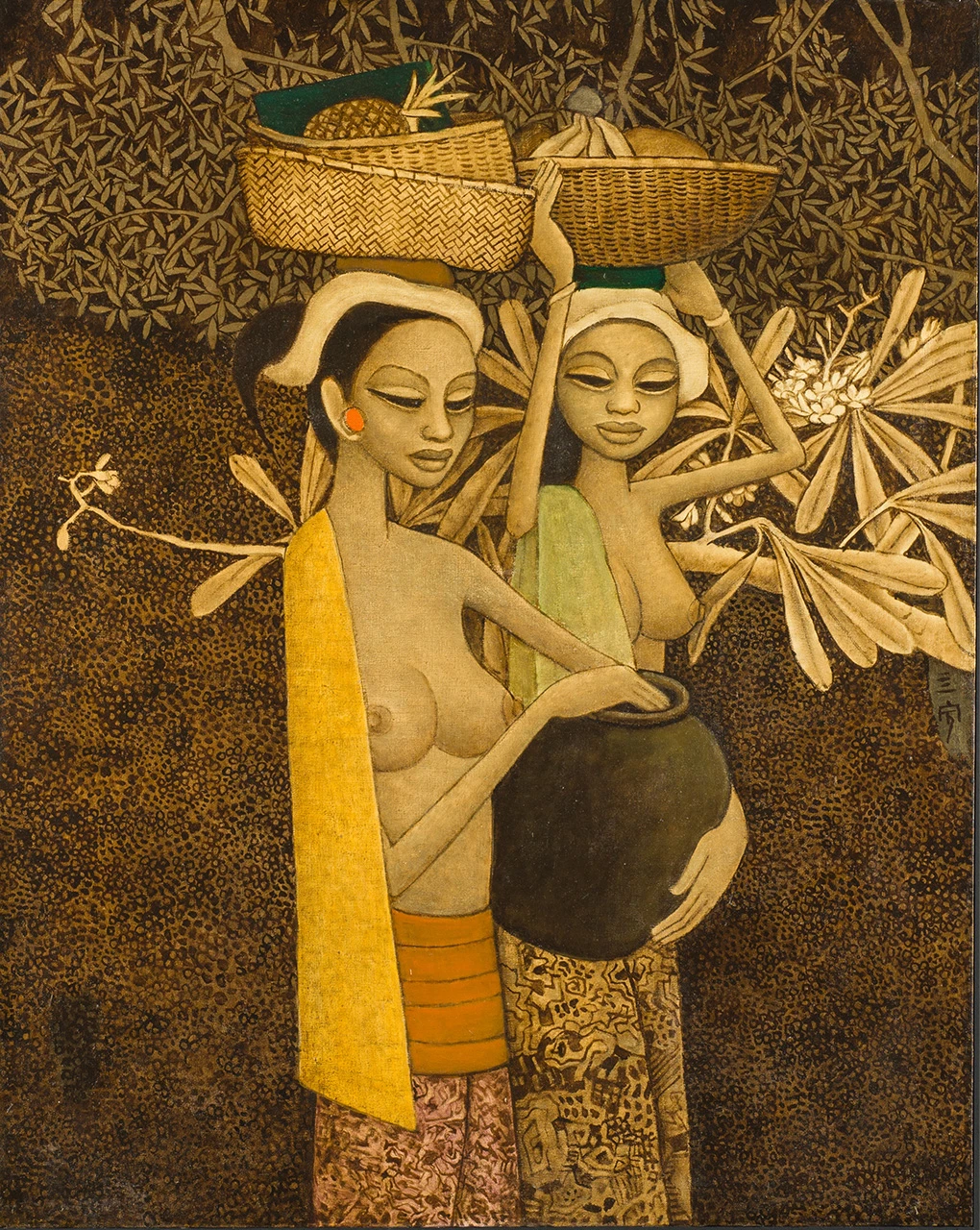

Donation of artwork is crucial to building the Singapore's National Collection. Over the years, the generosity of artists, artist families, collectors and corporate entities has had an important part to play in its growth.

Your contributions not only help preserve and showcase the rich artistic heritage of Singapore and Southeast Asia, but they also play a vital role in inspiring future generations of artists and the public. Learn more about our past donations and how your support creates a lasting impact by exploring the testimonies below.

Selected donations

Donating your artwork to the Gallery

All proposed donations are given careful consideration. We accept artworks that are aligned with our acquisition policy and collection strategy.

All gifts must be endorsed by the National Gallery’s Acquisition Committee and its approving authorities.

If you are considering donating an artwork to the Gallery, we would be pleased to advise you on the process and procedures.

Get in touch with the Collection Development Office by filling in and submitting this form.

For a general guideline, please refer to the Detailed Donation Procedures.

Detailed Donation Procedures

- Individuals/ organisations wishing to donate artwork should contact Collection Development office at the National Gallery Singapore.

- The donor shall demonstrate, supported by clear documentation, that they have the legal title to the artwork and are free from third-party claims.

- Singaporean and PR-holders are entitled to tax reliefs through donation. If the donor wishes for this option from Inland Revenue Authority of Singapore (IRAS), the Gallery will seek an external appraisal for the donated artwork. The external appraisal provides a fair market value at the time of acceptance.

- The Gallery may choose to consult external advisors, where appropriate.

- The donation proposal shall be tabled for consideration by the Gallery’s Acquisitions Committee. Upon endorsement by the Committee and approval by the Gallery’s Approving Authorities, a notification of acceptance and a Deed of Gift will be sent to the donor. The donor may wish to specify on the Deed of Gift their preference as to how the donated artwork shall be acknowledged during display or in a publication.

- The Deed of Gift signifies the transfer of the artwork’s ownership from the donor to the National Collection. The National Heritage Board (NHB) will be the legal custodian of all works in the National Collection, including centralised storage and conservation.

- Our climate-controlled and insured vehicle will transport the artwork safely to the Heritage Conservation Center (HCC), the repository and conservation facility for the management and preservation of Singapore's National Collection.

- For donors seeking tax reliefs, the Gallery will make the application on their behalf. Once the IRAS has granted approval, the donor does not need to make the claim in their income tax return as it will automatically be included in the tax assessment.

- When the tax deduction for the donation is more than the income for the year, the qualifying donor may carry forward the unutilised deductions for a maximum of 5 years. Please refer to IRAS website for most current guidance.

Frequently asked questions

To donate artwork, please follow our donation guidelines. All submitted artworks will be assessed by our curatorial team based on criteria including art historical significance, relevance to the Gallery’s mission and existing collection, condition, clear legal title of ownership, sound provenance, and authenticity. If necessary, the Gallery will engage an external valuer to determine the work's valuation. For inquiries, please contact us via email.

The Gallery collects significant artworks of modern and contemporary art of Southeast Asia – the region encompassing Singapore, Malaysia, Indonesia, Vietnam, The Philippines, Thailand, Myanmar, Cambodia, Laos, and Brunei – spanning the 19th to 20th centuries. We are particularly interested in works that address gaps in our collection and represent diverse voices from the region.

When submitting an artwork for donation, please provide the following information:

- A detailed description of the artwork (artist, title, date, medium, dimensions)

- High-quality images of the artwork

- Information about the artwork’s provenance, history of ownership and information about previous exhibitions and/or publications

- Your contact information and any relevant documentation regarding ownership

The Gallery may decline offers for various reasons, including that the artwork does not align with our strategic goals or collection focus. Other considerations may include the artwork's condition and its relevance to our mission.

All donors will be recognized for their contributions, regardless of the donation's size. Acknowledgment includes credit lines accompanying the works whenever they are displayed or published, invitations to exclusive donor events, and inclusion in our patron program. We value every contribution and are committed to honouring your support.

As a donor, you will enjoy several benefits, including:

- A Gold Patrons Card valid for one year, granting you special access and privileges at the Gallery.

- Invitations to exclusive donor events, where you can connect with other supporters and engage with our collections.

- Where applicable, the Gallery will nominate you for the Patron of the Arts Award, recognizing your significant contributions to the arts.

- As a registered charity, artworks donated by Singapore tax residents may qualify for tax benefits, subject to the terms set by IRAS, with a formal valuation required for tax purposes. Detailed information regarding eligibility and requirements may be found on the IRAS website

The valuation of donated artworks is conducted by an external valuer specializing in art appraisal. This external appraisal determines the fair market value of the artwork at the time of acceptance, which is used to assess eligibility for tax reliefs, as well as for GST and customs declaration purposes, where applicable.

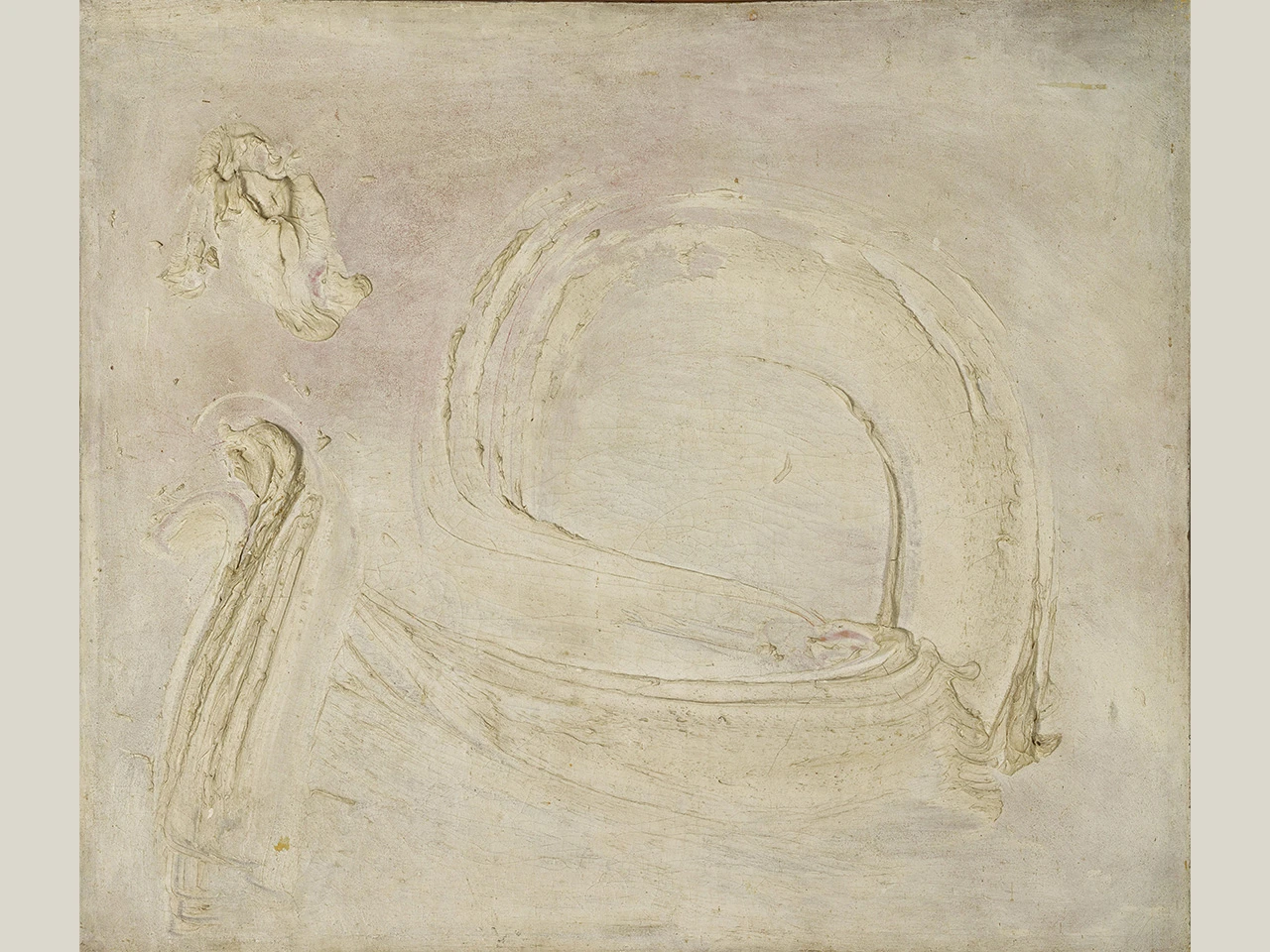

![White on White [No.6]](/content/dam/donate-and-volunteer/donate-an-arwork/artworks/white-on-white.webp)